Getting sued by a debt collector feels overwhelming, but you’re not powerless. Recent data shows consumer bankruptcy filings fell nearly 20 percent from last year, suggesting more people are successfully defending against Midland Funding LLC through strategic legal action rather than financial surrender.

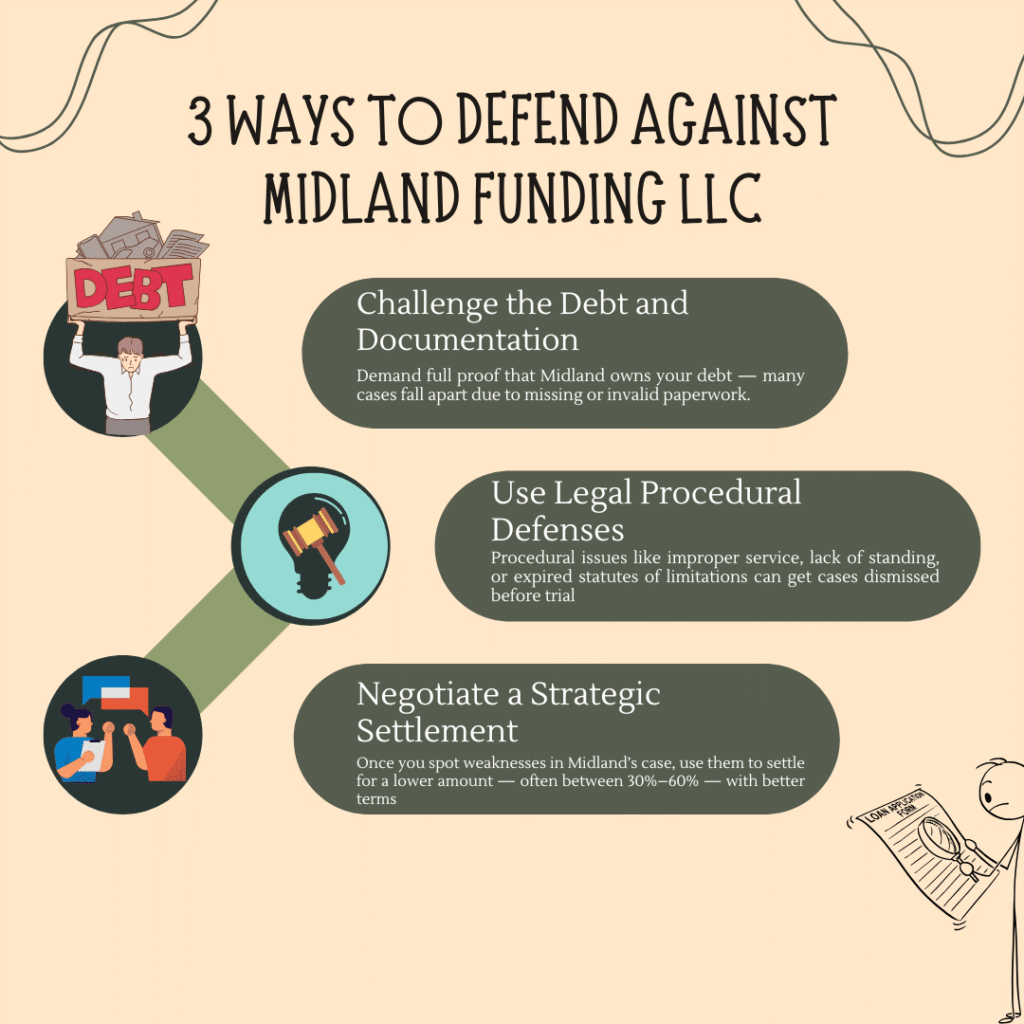

These three proven defense strategies can shift the power dynamic in your favor, giving you real options to protect your assets and credit score when facing aggressive collection tactics.

1: Challenge Documentation and Debt Validation

The foundation of any strong defense starts with questioning whether Midland has the legal right to collect from you. Most consumers don’t realize that debt buyers often purchase accounts with incomplete or questionable documentation.

Expose Documentation Red Flags

If you receive a document that you suspect may be a midland credit management fake summons, scrutinize it for signs of fabrication. Legitimate court papers should always contain unique case numbers, authentic court seals, and your correct personal information. For anyone facing a midland funding lawsuit, it’s essential to authenticate any legal notices directly with your local court clerk instead of relying solely on mailed paperwork.

Fake summonses often contain generic language, incorrect court addresses, or suspicious formatting. These red flags can form the basis of your entire defense strategy, potentially leading to case dismissal before you even enter a courtroom.

Demand Comprehensive Debt Validation

Federal law requires debt collectors to prove they own your debt and have accurate account information. If you have been sued by midland credit management, act quickly by requesting detailed validation documents. This should include the original creditor agreement, a complete payment history, and evidence establishing the legal transfer of debt ownership.

Many debt buyers can’t provide this documentation because they purchase accounts in bulk with minimal paperwork. Missing validation documents can halt collection efforts entirely, giving you significant leverage in any potential settlement discussions.

Attack Insufficient Record-Keeping

Debt buyers often maintain sloppy records, creating opportunities for successful challenges. Chain of custody gaps in purchased debt portfolios frequently leave collectors unable to prove continuous ownership from the original creditor to their current claim.

2: Leverage Legal Procedural Defenses

Understanding court procedures can provide powerful defensive tools that many consumers overlook. These technical defenses often prove more effective than arguing about the debt’s validity.

File Strategic Motions to Dismiss

Courts must follow specific rules about where lawsuits can be filed and who has legal standing to sue. Challenge the improper venue if Midland filed in a court that lacks jurisdiction over your case. Similarly, question their legal standing to collect if they can’t prove actual ownership of the debt.

Statute of limitations defenses vary by state but can eliminate valid collection claims. If the debt is old enough, Midland may have waited too long to sue, making their entire case legally worthless.

Challenge Service of Process Issues

If you are involved in a midland credit management lawsuit and notice that the service of process did not comply with legal standards, improper service methods could be grounds for dismissal, regardless of the underlying debt’s validity. Keep careful documentation of any service violations, as such technicalities can be effective where other defenses might not succeed.

Consumer bankruptcy filings down 10 percent through nine months of 2011 partly reflect successful procedural defenses that resolve cases without forcing consumers into bankruptcy court. These victories demonstrate that technical challenges can prevent worst-case financial outcomes.

Exploit Robo-Signing and Affidavit Problems

Mass-produced affidavits in Midland cases rarely contain personal knowledge of your specific account. Challenge witness credibility when affidavits appear generic or contain obvious errors. Document authentication becomes crucial when collectors submit suspicious paperwork to support their claims.

3: Negotiate Maximum Settlement Advantages

Once you’ve identified weaknesses in Midland’s case, you can negotiate from a position of strength rather than desperation. Smart settlement strategies protect both your immediate finances and long-term credit health.

Research Settlement Benchmarks

When analyzing your options, knowing the midland credit management settlement percentage benchmarks is critical. Industry standards suggest settlements between 30% and 60% of claimed amounts, depending on the debt’s age and your case’s specific weaknesses.

Document all case weaknesses you’ve identified through documentation challenges and procedural defenses. These discoveries become valuable negotiation leverage, potentially reducing settlement amounts significantly below standard ranges.

Calculate Your Negotiation Position

Asset protection considerations matter before entering settlement talks. Evaluate what Midland could collect through judgment and garnishment, then offer settlements based on realistic collection potential rather than claimed debt amounts.

Payment structure options can benefit you even when agreeing to substantial settlements. Lump-sum payments often receive better percentage discounts, while payment plans may include interest and fee reductions that save money over time.

Secure Ironclad Settlement Agreements

Essential settlement terms must include credit reporting removal guarantees and protection against future collection attempts by Midland affiliates. Without these protections, settlements may resolve current lawsuits while leaving you vulnerable to related collection actions.

Post-settlement credit repair requires expedited reporting procedures and dispute processes for incomplete settlement updates. Building positive credit history after resolution helps offset any remaining negative impacts from the original collection account.

Taking Control of Your Financial Future

These three defense strategies work best when combined rather than used individually. Documentation challenges expose weaknesses, procedural defenses create legal leverage, and strategic settlements protect your long-term interests.

Consumer bankruptcy filings continue declining partly because more people recognize they have real options when facing debt collection lawsuits. Don’t let fear or intimidation prevent you from exploring every available defense, your financial future depends on taking informed action now.

Common Questions About Midland Funding LLC Defense

What are the three things debt collectors need to prove?

Debt collectors must prove three key things: that the debt is yours, that the amount is correct, and that they have the right to collect it. If they can’t, they’re not allowed to continue pursuing you for payment.

How can I tell if a Midland Credit Management summons is fake?

Examine court seals, case numbers, and formatting carefully. Verify through your local court clerk rather than trusting the documents alone, as fake summonses often contain generic language or incorrect court information.

What percentage of cases does Midland Funding LLC typically settle for?

Most settlements range between 30% and 60% of claimed amounts, though strong defenses can reduce this significantly. Your specific percentage depends on case weaknesses, debt age, and negotiation leverage you’ve developed.